Did you know that almost 280,000 consumers traded CFD products each month in 2017? There are one hundred various specialized CFD providers that have been authorized by the FCA.

FCA investigation indicated that 82 percent of CFD consumers lose money. The average loss while trading these goods is £2,200. New FCA restrictions are projected to save customers between £267 million and £451 million per year.

In 2018, there were roughly 100 FCA-authorized specialist CFD providers. In 2018, there were more than 800,000 retail client accounts that were funded via CFDs. In 2017, retail client accounts traded CFDs on a monthly basis at a rate of 279,000 on average. The cumulative value of holdings in these accounts is almost £1.5 billion. In the year 2020, there was an all-time increase in the number of people searching for CFD trading. In 2020, the average search interest in “CFD trading” was up 193 percent in comparison to 2019. There is now over 4x more search interest in CFD trading than there was in 2015. Search interest is anticipated to continue to climb over 2021.

The FCA announced regulations relevant to the CFD market. This was after studies revealed that over 80 percent of CFD clients lose money while trading these products. FCA investigation indicated that 82 percent of CFD consumers lose money. When dealing with these items, the average loss amounts to $2,200. It is anticipated that the actions taken by the FCA will save retail customers between £267 million and £451 million annually.

With the rise in the level of interest that people are taking in CFD, so too are scams and crimes related to CFD trading. This article covers everything from what CFD trading actually is, CFD scams and its different types, certain blacklisted companies to be on the lookout for, and how you can retrieve your lost funds.

What is CFD Trading?

CFDs are contracts between buyers and sellers that require that the buyer must pay the seller the difference between the current value of an asset and that asset’s worth at the time the contract is entered into.

With CFDs, traders and investors have the potential to profit from price movement without having to hold the underlying assets themselves. The value of a contract for difference (CFD) does not take into account the actual value of the underlying asset; rather, it takes into account just the price change that occurred between the time the transaction was entered and when it was exited. Instead of using a stock, FX, commodities, or futures market, this is performed through the execution of a contract between the client and the broker. This is in contrast to the traditional method of using a market. Trading contracts for difference (CFDs) comes with a number of major benefits, all of which have led to the massive rise in popularity of the instruments over the course of the previous decade.

It is said that an investor and a contract for differences (CFD) broker have entered into a contract for differences when they agree to exchange the difference in the value of a financial product between the dates on which the contract opens and closes. The dates on which the contract opens and closes are known as the opening and closing dates of the contract.

Investors in contracts for difference (CFDs), in contrast to investors in traditional investments, do not really own the underlying asset; rather, they get revenue that is based on the change in the value of the asset. CFDs, for instance, allow investors access to underlying assets at a price that is cheaper than the cost of owning the assets outright. Furthermore, CFDs enable faster execution and permit investors to take long as well as short positions in the asset. CFDs have a number of potential drawbacks, one of which is an instantaneous decline in the value of the investor’s initial position. This decline is caused by the magnitude of the spread, which is lowered when the investor initially joins the contract. In addition to that, there is a deficiency in the amount of industry regulation, the likelihood of a liquidity deficit, and the obligation to keep a suitable buffer at all times.

A contract for differences, also known as a CFD, is an agreement between an investor and a contract for differences broker (also known as a CFD broker) to exchange the difference in the value of a financial product (either a security or a derivative) between the time the contract opens and the time the contract is closed. A contract for differences, also known as a CFD, is also known as a contract for differences broker. Because of the complexity of this trading method, only experienced traders and investors should attempt to put it into practice. Contracts for difference (CFDs) do not include the actual shipment of physical commodities or the exchange of securities in any way.

Investors in contracts for difference (CFDs), in contrast to investors in traditional investments, do not really own the underlying asset; rather, they get revenue that is based on the change in the value of the asset. A trader doesn’t actually have to buy or sell gold in order to speculate on whether or not the price of gold will rise or fall; instead, they just need to decide whether they think it will or won’t happen. CFDs, or contracts for difference, allow investors to essentially put bets on whether or not the price of an underlying asset or security will increase or decrease in the future. Those who trade on the market have the choice to place their wagers either on an upward or a negative trend. If a trader who has already purchased a CFD monitors the price of the underlying asset and observes that it has climbed, then that trader will put their holding up for sale.

The amount of the net differences is equal to the sum of the disparities between the purchasing price and the selling price. The brokerage account of the investor is responsible for settling the resulting net difference between the two deals, which indicates the profit made from the trades. It is possible to initiate a sell position at a higher level for those who have the opinion that the value of the asset will go down in the near future. In order to complete the closing of a position in a trading account, the purchase of an offsetting trade is obligatory. The following step is the distribution of cash to them through their account equal to the difference between the net profit and the net loss.

In the United States, contracts for difference (CFD) are not allowed. In many of the world’s most important financial centers, such as the United Kingdom, Germany, Switzerland, Singapore, Spain, France, South Africa, Canada, New Zealand, Hong Kong, Sweden, Norway, Italy, Thailand, Belgium, Denmark, and the Netherlands, they are permitted on both listed and over-the-counter (OTC) markets. OTC stands for over-the-counter. In many of the world’s most important trading nations, including the United States, it is against the law for these to be traded in unlisted and over-the-counter (OTC) marketplaces.

Even though CFD contracts are now allowed in Australia, the Australian Securities and Investment Commission (ASIC) has declared that they will be changing the method that CFD contracts are created and disseminated to retail customers in the near future. According to the regulator, CFD leverage that is available to retail clients is being decreased, and CFD product features and sales practices that amplify retail clients’ losses are being targeted in an effort to strengthen consumer protections. Both of these measures are being taken in an effort by ASIC to strengthen consumer protections. On March 29, 2021, the Product Intervention Order that had been issued by ASIC started to be put into action. The United States Securities and Exchange Commission (SEC) has placed restrictions on the trading of CFDs within the United States; however, trading is still allowed for those who are not residents of the country.

The spread is the difference between the buy price (bid price) and the offer price at the moment you trade. The fees associated with trading CFDs include a commission (in some cases), a financing cost (in some scenarios), and the spread. When calculating the cost of trading CFDs, commissions and financing expenses are not taken into account. Trading foreign currency pairings and commodities normally does not involve the payment of commissions. On the other hand, brokers will often extract a commission from stock transactions.

For instance, the financial services provider CMC Markets, which has its headquarters in the United Kingdom, begins charging commissions for stocks that are traded on the New York Stock Exchange and the Toronto Stock Exchange at a rate of 0.10 percent, which translates to $0.02 per share. This rate is applicable to both exchanges. You will be required to pay a commission for each transaction as a result of the fact that opening and closing trades are considered to be two distinct transactions. Because overnight positions in a product are considered investments, you may be required to pay a financing charge if you have a long position in that product (and the provider has lent the trader money to buy the asset).

When a trader maintains a position in their account for more than one day, the customary practice is to assess the trader with an interest fee. For the sake of illustration, if a trader wanted to buy CFDs at the share price of P&G, he would submit the following information: A deal with a value of £10,000 is made by the trader in this scenario. At the moment, one share of P&G can be purchased for £23.50. In the not-too-distant future, the market participant forecasts that the share price will increase to £24.80 per share. The difference between the bid and the offer is currently 23.50 cents, with a percentile range of 24.80.

When the position is opened, the trader will be responsible for paying a commission of 0.1 percent. When the position is closed, the trader will be responsible for paying another 0.1 percent commission. A financing fee will be imposed overnight to traders who hold long holdings. This fee will be applied only to traders who hold long positions (normally the LIBOR interest rate plus 2.5 percent). As a result of the trader’s purchase of 426 contracts at a price of £23.50 per share, the total value of the trader’s position is £10,011. Let’s say that in the next 16 trading days, the share price of P&G reaches £24.80, up from where it is right now. The value of the transaction is £10,011 when it first begins, but it ultimately winds up being worth £10,564.80.

Some financial analysts and regulators are concerned about the manner in which CFD providers promote the products they offer to new and inexperienced traders because of the way in which CFDs are being offered to them. This includes the manner in which prospective profits are advertised in a way that does not completely convey the risks that are associated with the process. The majority of financial regulators who are in charge of regulating CFDs have mandated that prominent risk warnings be displayed on all forms of advertising and websites, as well as when new accounts are opened, among other things. This is both in anticipation of and in response to the concern that has been raised.

According to the Financial Services Authority (FSA) of the United Kingdom, CFD providers are required to evaluate the suitability of CFDs for each new client based on their experience. They must provide a risk warning document to all new clients that is based on a general template developed by the FSA.

Additionally, CFD providers are required to assess the suitability of CFDs for each new client based on their experience. CFD trading, according to the trader information website maintained by the Australian financial authority ASIC, carries a greater level of risk than either betting on horses or going to a casino. It is recommended that trading in contracts for difference (CFDs) be carried out by persons who have substantial trading expertise, particularly during times of turbulent market conditions, and who are able to suffer losses that cannot be prevented by any trading strategy.

A further worry is that contract for difference (CFD) trading is not much different from gambling, which would mean that the vast majority of traders that participate in CFD trading lose money. However, the prices of CFDs are based on publicly available underlying instruments, and the odds are not stacked against traders because the CFD is simply the difference between the price of the underlying and the price of the underlying. It is impossible to determine the average returns from trading because there are no reliable statistics available, and CFD providers do not publish such information.

It is mostly done over the counter (OTC) and there is no standard contract in place, trading in CFDs is not transparent, which is another issue that raises concerns. This lack of transparency is a cause for concern. As a consequence of this, some people have theorized that providers of CFDs would be able to take advantage of their customers. This is a subject that is regularly discussed in online trading forums, particularly in relation to the regulations that govern the process of putting in place stops and closing out positions in the event of a margin call. The Australian Securities Exchange, which is promoting their Australian exchange-traded contract for difference (CFD), as well as some CFD providers who are marketing direct market access products, are also using this method to support their particular offering.

They argue that their product can reduce the likelihood of occurrence of this particular risk in some fashion. The counterargument states that there are multiple CFD providers and that the industry is extremely competitive. According to the argument, there are more than twenty CFD companies in the United Kingdom alone. If a client was having issues with a particular service provider, they had the option to switch to another supplier. According to the Commodity Futures Trading Commission (CFTC), a portion of the criticism that is leveled at CFD trading is associated with the fact that CFD brokers are unable to advise their consumers about the psychology that is involved in this type of high-risk trading. When consumers go from a practice account to a real account, variables such as the fear of losing become a reality for them. This worry presents itself in the form of neutral positions or even losing positions.

The vast majority of CFD brokers do not offer any supporting documentation for this assertion. The method that some CFD providers use to hedge their own exposure has also come under fire, as has the possibility for a conflict of interest that this method may generate when it comes to determining the parameters under which a CFD can be traded. One report claims that certain CFD providers had been taking positions against their customers based on the customer profiles of those customers in the hope that those customers would lose, which resulted in a conflict of interest for the CFD providers themselves.

It has been stated that contracts for difference (CFDs), when supplied by providers operating under the market maker model, are comparable to the bets that were popular in the United States at the turn of the twentieth century and were sold by bucket shops. The outcome of this was that the speculator was effectively betting against the house, as they were able to place highly leveraged bets on equities that were not normally backed or hedged by actual trades on an exchange. According to the author of the semi-autobiographical novel Reminiscences of a Stock Operator, Jesse Livermore, bucket shops are deemed illegal in the United States under both criminal law and securities law, notwithstanding the author’s captivating descriptions of the practices in the book.

Blacklisted CFD Trading Companies

CFD Royal

According to the most recent examination of CFD Royal, the company appears to be operating unlawfully and without the appropriate license required by financial regulatory authorities. According to the findings of our investigation, CFD Royal is an elaborate fraud.

Elit Property Vision LTD, whose registered address is in Sofia, Bulgaria, is the owner and operator of the CFD Royal trading platform. On the other hand, the broker is not licensed or regulated in any way, either by the Financial Supervision Commission in Bulgaria or any other authority.

When it comes to offering and providing financial services, Forex and CFD brokers are needed to get a license from the local financial authorities in order to do business. Given that CFD Royal does not hold such a license, it is impossible to recommend them as a reliable broker with which to invest. We have uncovered a few questionable practices that ought to be brought to your attention. The owner firm, Elit Property Vision LTD, also owns other brokerages, such as CarterFS and RichmondFG, all of which were discussed in the previous section. The fact that these businesses have been placed on blacklists more than once by a variety of regulators is something that does not inspire a great deal of confidence in CFD Royal.

Another interesting fact is that an offshore corporation with its headquarters in the Marshall Islands, known as United Limited, was the former owner of CFD Royal. The Marshall Islands are known for having virtually no rules and regulations to follow, which has earned them a bad reputation. As a result of the low cost of setup and the fact that it does not control FX trading. And finally, traders should steer clear of CFD Royal because the company has been barred from operating in the United Kingdom by the Financial Conduct Authority: “This company (CFD Royal) is neither authorized or registered by us; however, it has been targeting individuals in the UK while falsely pretending to be an authorized firm.”

We strongly encourage all potential traders and investors to steer clear of CFD Royal and any other unregulated brokers. Those individuals who intend to invest with the entity should consider the absence of information on the regulation of the broker, trading conditions, and contact details to be the most significant warning sign. Typically, these businesses are fronts for fraudulent investment schemes.

CFDxp

CFDxp was an offshore Forex and Cryptocurrency broker that just opened its doors on the 21st of October, 2018. FBR Investments Ltd. is the owner of CFDxp and the company that runs it. According to the findings of our analysis of the broker CFDxp, this broker makes available to investors the web-based trading platform developed by Proftit.

This trading software makes Contracts for Difference (CFDs) available on Forex pairings as well as the vast majority of cryptocurrencies and virtual tokens. There are about 180 underlying assets that may be traded using CFDs, which is a significant number. CFDxp is not a legitimate broker in any way. It has come to our attention that this broker is owned by the same entity as ZeusOption, which is no longer in business.

The FCA in the United Kingdom, the SEC in the United States, or ASIC in Australia are examples of government agencies that provide licenses and regulate legitimate CFD brokers. The majority of the trading conditions on CFDxp are obscured, which is suspicious. In conclusion, we do not advise you to trade with CFDxp despite the fact that it offers favorable trading conditions. This is due to the fact that the company is not regulated, and there is a possibility that it is a scam. Because CFDxp is capable of causing enormous losses for its clients, we believe that the company engages in fraudulent activity.

When it comes to trading items, some brokers may offer a wide selection, while other brokers may choose to concentrate in a single market, such as the foreign exchange market. Traders should only conduct business with brokers who are subject to stringent regulations (like those in the UK or Australia) and who have a solid reputation. Make sure that regardless of what trading items you discover in the CFDxp reviews, the company in question has been granted authority to trade the products that they make available to customers.

Because there was some suspicion that CFDxp was a scam broker, we do not suggest doing business with them. The Financial Conduct Authority (FCA) strongly recommends that individuals in the UK do not invest with this particular broker. However, in order to carry out these activities, the Forex broker does not possess the necessary FCA license. Even though the VFSC has issued the Forex broker with a license, this alone does not qualify them to provide financial services or products in the UK or Europe. In any event, as Vanuatu is considered an offshore zone, we strongly advise investors to be very selective when selecting the brokers with whom they would conduct business.

We strongly advise any and all investors and traders to steer clear of CFDxp and any other brokers based in Vanuatu. If you are interested in trading commodities, foreign exchange, cryptocurrencies, or CFDs, paying close attention to the broker you trade with will help you avoid broker fraud and prevent problems with withdrawals.

CFDs100

CCLR Solutions Limited and TRSystem Ltd. are the companies that own the online trading broker known as CFDS100. Trading with CFDs100 is not a risk-free activity. It is claimed to be based in Tallinn, Estonia, and is run by CCLR Solutions Limited, which also owns and operates the website.

Clients from all around the world have the chance to invest in over one thousand world-class assets through CFDs100. These assets include cryptocurrencies, FX, equities, commodities, and indices. The company claims on its website that it is registered in Estonia in accordance with the Companies Law and that its registered office is in the city of Tallinn. Despite this, the broker does not have the necessary authorization to offer its financial services in Estonia or any other EU country.

In addition, CFDs100 is stated to be subject to the law of the nation of Vanuatu, as stated in the terms and conditions. The notoriously lax laws and regulations in Vanuatu have earned the country a bad reputation. As a result of the low cost of setup and the fact that it does not control FX trading. As a result, it turned into an offshore zone wherein dodgy forex brokers like IC Finance and 70 Trades, and others could operate from.

In addition to this, the Estonian Financial Supervision Authority issued a warning against the company in the month of August 2018: “The Estonian Financial Supervisory Authority would like to inform clients and investors that TRSystem OÜ (registry code 14468050) does not hold an activity license for the provision of investment services in Estonia and, as a result, TRSystem OÜ is not authorized to provide investment services in Estonia,” says Finantsinspektsioon. “The Estonian Financial Supervisory Authority would also like to inform clients and investors that TRSystem OÜ does not hold an activity license for the provision.

Additionally, the United Kingdom’s Financial Conduct Authority has placed the brokerage on a “blacklist”: “We have not authorized this company (TRSystem doing business as CFDS100), and it is soliciting customers in the United Kingdom. According to the information that we have, we have reason to suspect that it is engaging in activities that are subject to regulation and require authorization.

A recent warning against CFDs100 (CCLR Solutions Limited) was issued by the Austrian regulator Financial Markets Authority (FMA): “CFDS100 LTD (CCLR Solutions Limited) is not authorized to provide banking services or investing services in Austria that require a license. These are examples of services that are regulated by the Austrian Financial Market Authority. Therefore, the provider is not allowed to engage in commercial trading, either for its own account or on behalf of others, nor is it permitted to offer financial advice.

We strongly recommend that any and all traders and investors stay away from CFDs100 and any other brokers based in Vanuatu. Traders should only conduct business with brokers who are subject to stringent regulations, such as those found in the United Kingdom or Australia, as well as reputable brokers like FP Markets and TMGM.

CFDStocks

Trading in CFD Stocks, in addition to Binary Options and other instruments, is made available by the company Pacific Sunrise UK Ltd, which is also known to operate under the name Aaoption. CFDStocks is a brand name that is used by this company.

In addition to providing services in multiple languages via their website, CFDStocks lists its address as being in London, United Kingdom. The company also serves customers via multiple phone lines, some of which are located in New Zealand, Norway, and Austria. However, in order to operate within the bounds of the law, any financial service broker or investment firm that is based in the UK needs to be licensed by the Financial Conduct Authority (FCA) (Financial Conduct Authority). In point of fact, CFDStocks does not possess any license, be it particular or otherwise; as a consequence, the company is regarded as an unlawful corporation that is not permitted to provide the service it performs.

In addition to the legal problem, the broker got into trouble by providing its services in other countries, which also covers areas in Asia and Australia, among other places. Due to the possibility that the company is participating in a fraud, the Australian regulator ASIC issued a warning about it and categorized it as a company that should be avoided.

“The company described below, Pacific Sunrise UK Ltd, or CFDStocks, also known as Aaoption, has made unsolicited calls or sent unsolicited emails concerning credit, loans, investment, or financial advice. The business does not have a valid license to conduct Australian Financial Services (AFS) or Australian Credit from the Australian Securities and Investments Commission (ASIC). The Australian Securities and Investments Commission (ASIC) has issued a warning that this company may be participating in a scam. Because this company lacks a license, you should avoid doing business with it. Traders are urged to give careful consideration to this matter when selecting a trading broker and to select one from a group of regulated companies, such as ASIC-regulated brokers or others of a similar nature because these organizations comply with international laws and the provision of financial services. If this is not the case, investments and trading become extremely risky activities that could result in a loss of capital.

CFDPremium

CFDPremium, which can be found online at Cfdpremium.com, is a fraudulent CFD and Forex Broker platform operating in the Forex market.

This platform reportedly differs from those offered by other Forex brokers, as stated on the website. They assert that they are the most forward-thinking and that they were developed by actual traders. The CFDPremium website makes the claim that customers will have the opportunity to trade just like experts. According to the information provided on their website, their trading platform is among the most widely used in the sector. When trading with CFDPremium, customers do their business on MetaTrader5. On their website, the platform can be downloaded quickly and easily, which is something that we had trouble doing. The download failed to finish and got stuck at around the 25 percent mark. When you download a false platform, your device will become unresponsive, as is the case with most of them.

CFD Premium asserts that some of the trading items it offers include precious metals, oil, foreign exchange (Forex), CFDs, indices, and algorithmic trading. If only CFDPremium could be made to function properly, these trading instruments would be excellent. Yes, the findings of this review will make it very plain why we do not put any stock in what this platform has to say. Because there have been so many complaints about this, we are confident that it is another Forex scam with the intention of defrauding millions of consumers.

His broker asserts that your funds will be protected at all times. Because the vast majority of people have reported suffering significant financial losses as a result of their involvement with CFDPremium, we are confident that this assertion is not accurate. The fact that their website is not encrypted is a warning sign that should not be ignored. This indicates that it is simple for hackers to take control of trade and steal from CFD Premium.

According to CFDPremium, the entirety of the website is secured using an SSL encryption key that is 256 bits in length. The only item that we discovered was a True-Site identity assurance stamp that may be downloaded at your convenience. These individuals are unable to provide any assurance that client money will be held in a manner that is distinct from those of the organization. If this were the case, then they would have compensated those customers who suffered financial losses as a result of their business. The assertion that customers have a 100% chance of getting their money back is plainly a deception. It has come to our attention that CFDPremium is willing to work with a variety of payment methods. MasterCard, OKPAY, PAYEER, PayPal, QIWI, and Request Payment are the payment methods that are accepted here.

The strange thing is that this platform is very quick when it comes to the processing of deposits. The deposits are processed fairly instantly, and you can check to make sure that they have been credited to your account. Everything about this seems like it’s too wonderful to be true. You need to wait till you can start withdrawing money. When a person wishes to take a certain amount of money out of their account, hell breaks loose immediately. The issue with using CFD Premium is that customers are unable to withdraw their own money from the platform. This is the reason why there are so many people claiming to have been taken advantage of by CFDPremium on the internet. We have reason to suspect that this is a con that seeks out victims, convinces them to sign up, and then takes their money.

We strongly recommend that you do not register for this service. Also, disregard any and all incoming emails from individuals who identify themselves as agents of CFD Premium. Never click on any link that takes you to their homepage, regardless of how tempting it may seem. It is in your best interest to avoid disclosing any information about your credit card, as doing so puts you at risk of becoming a victim of credit card fraud.

Lost money to online fraud? We will recover your funds !

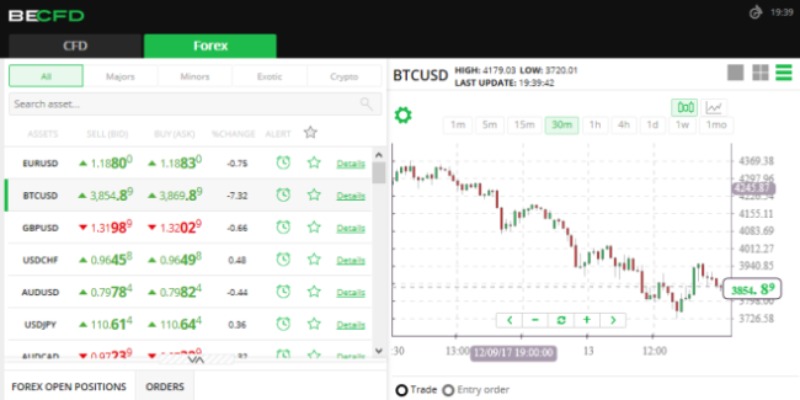

BECFD

There is a widespread suspicion that BECFD is a fraudulent broker. This broker is on a “blacklist” maintained by a reputable regulatory entity, so you should steer clear of doing business with them.

BECFD is an offshore firm that is owned and operated by BECFD Limited, which is a company that is registered in the Marshall Islands. The Forex and CFD brokerage firm known as BECFD is owned and run by a company known as BECFD Limited. The company is registered in the Marshall Islands, an offshore zone when brokers are usually not regulated, nor supervised.

There is not a great deal of information regarding the broker that can be found on the internet; all that is provided are two phone lines, one British and one Austrian. It indicates that BECFD has been making efforts to provide its services in these nations, and it also indicates that they have been making these efforts while not being regulated or authorized to do so.

In addition, the Austrian Federal Market Authority (FMA) has just issued a warning against this company. We are always advising traders that working with offshore brokers is fraught with danger because there is no safeguard in place to protect their funds. We strongly advocate opening a trading account with just those brokers who are regulated by the recognized world authorities and who comply with the required set of rules and have maintained a good reputation throughout the timeframe in which they have carried out their activities. Traders should only conduct business with brokers that are adequately supervised, such as those located in the United Kingdom or Australia, as well as reputable firms like BlackBull Markets and Pepperstone.

SwiftCFD

Trading with SwiftCFD is not a risk-free activity. The Marshall Islands serve as the location for the offshore headquarters of Digital Enterprise Ltd., the business that owns and operates SwiftCFD.

The Marshall Islands are known for having virtually no rules and regulations to follow, which has earned them a bad reputation. As a result of the low cost of setup and the fact that it does not control FX trading. As a result of this, it turned into an offshore zone where dodgy forex brokers like YFX Capital and Pinprotrade and others could operate. According to the company’s website, SwiftCFD is a cutting-edge consumer trading company that provides its customers with a simple and user-friendly method to trade on all of the major financial markets, such as Forex, Commodities, Indices, or Stocks. Digital Worldwide OU, a separate business with its headquarters in Estonia, is the entity that is responsible for the brand’s name.

Despite this, the Estonian Financial Supervision Authority has not granted the company permission to operate. Avoiding SwiftCFD and any other products sold by the Digital Worldwide OU is something that we strongly recommend all investors and traders do.

CFD Global FX

It is clear from looking at their website that they are not subject to the jurisdiction of any particular regulatory body. That should immediately come across as a red flag.

That alone should dissuade you from making any investments with them. They also work with websites that provide “Automated trading software,” which is another red flag because websites of this type are extremely well-known for their involvement in various types of scams. Therefore, CFD Global FX is just another uncontrolled forex broker. This indicates that the consumers are not protected, and it is quite probable that they will get away with stealing your hard-earned money without being held accountable by a regulatory organization.

How Long Has CFD Trading Been Around For?

CFDs were initially presented as a type of equity swap that could be traded on margin and made their debut in London in the early 1990s. Since then, they have seen an increase in their level of popularity.

Many people believe that Brian Keelan and Jon Wood, both of UBS Warburg, came up with the concept of the CFD while they were working on the Trafalgar House deal in the early 1990s. If this is true, then they were the pioneers in developing this financial instrument. Because they required only a small margin and, more importantly, because no physical shares were exchanged, they were able to avoid paying stamp duty in the United Kingdom because no physical shares were exchanged CFDs were initially used by hedge funds and institutional traders to gain cost-effective exposure to stocks listed on the London Stock Exchange.

In part, this was because CFDs required only a small margin, and in part, this was because CFDs allowed traders to avoid paying stamp duty in the United Kingdom. Even though CFDs have risk and leverage profiles that are comparable to those of physical holdings, hedge funds and other asset managers continue to use CFDs as a substitute for physical holdings (or physical short selling) of UK listed equities. This is the case despite the fact that CFDs have an identical risk profile to physical holdings. Frequently, the primary broker of a hedge fund will function as the counterparty to a contract for difference (CFD), and it will employ physical stock trading on the exchange to hedge its own risk in connection with the CFD (or its net risk under all CFDs held by its clients, long and short). Trades that are executed by the prime broker for its own account and with the intention of hedging will not be subject to stamp duty in the United Kingdom.

In the late 1990s, retail traders were given access to CFDs for the very first time. Their broad appeal was defined by innovative online trading systems that made it simple to view live prices and deal in real-time. This popularity was boosted to by a large number of enterprises based in the United Kingdom. In this sense, GNI was the first company to do so; GNI and its CFD trading service GNI Touch were eventually bought by MF Global. GNI was formerly known as Gerrard & National Intercommodities. They were immediately followed by IG Markets and CMC Markets, both of which began popularizing the service in 2000, not long after they launched their businesses. Around the year 2001, a number of providers of CFDs came to the realization that CFDs had the same economic effect as financial spread betting in the United Kingdom, with the exception that profits from spread betting were not subject to Capital Gains Tax in the United Kingdom.

This realization occurred around the same time that a number of CFD providers began to realize that CFDs had the same economic effect as financial spread betting in the United Kingdom. The vast majority of CFD providers, in addition to selling contracts for difference (CFD), also established financial spread betting activities. The CFD market and the financial spread betting market are extremely comparable in the United Kingdom, and the goods on both of these markets are also very comparable to one another. Spread betting, on the other hand, has mostly remained a phenomenon in the United Kingdom and Ireland, in contrast to CFDs, which have been exported to a number of different countries across the world. This is because spread betting is dependent on a tax advantage that is peculiar to a country.

After that, CFD providers started to expand into other international markets, and in July 2002, IG Markets and CMC Markets both commenced operations in Australia. This was the beginning of the CFD providers’ global expansion. Since that time, contracts for difference (CFDs) have been made legitimate in a variety of additional nations. It is possible to purchase them in the following nations: Australia, Austria, Canada, Cyprus, France, Germany, Ireland, Israel, Italy, Japan, the Netherlands, Luxembourg, Norway, Poland, Portugal, Romania, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, Turkey, the United Kingdom, New Zealand, and Turkey. In addition to that, you can get them in the following countries: CFDs are not allowed to be listed on regulated exchanges in the United States by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) because of the high volatility of the markets.

This prohibition is in place in the United States as well as in a number of other countries. Trading in contracts for difference (CFD) is fully outlawed by the Securities and Futures Commission of Hong Kong. On the other hand, people who live in Hong Kong have the ability to trade CFDs through overseas brokers. In 2016, the European Securities and Markets Authority (ESMA) issued a warning on the selling of speculative products to retail investors. This warning also included the sale of futures contracts, and it listed CFDs as one of the items covered by the alert.

However, the Australian Securities Exchange (ASX) did offer exchange-traded CFDs from 2007 to June 2014, but only for a brief period of time. The majority of CFDs are traded over the counter (OTC) utilizing the direct market access (DMA) or market maker model. As a direct consequence of this, the Australian exchange was only involved in a negligible proportion of the CFD transactions that occurred during this time period. When it comes to the majority of financial products, the benefits and drawbacks of having an exchange-traded CFD are comparable to those of other financial products. The presence of an exchange-traded CFD resulted in a reduction in counterparty risk and an improvement in transparency; yet, this resulted in higher expenses.

Over-the-counter contract for difference (CFD) providers have become increasingly popular among Australian traders as an alternative to ASX exchange sold CFDs, which have a number of drawbacks, including a lack of liquidity. In June of 2009, the Financial Services Authority (FSA) of the United Kingdom adopted a general disclosure framework for contracts for difference (CFDs), with the goal of preventing CFDs from being used as evidence in instances involving insider information. This came as a result of a series of high-profile cases in which positions in CFDs rather than the physical underlying stock were utilized to circumvent disclosure obligations imposed by the standard insider information disclosure laws. In October 2013, LCH. Clearnet, together with Cantor Fitzgerald, ING Bank, and Commerzbank, launched centrally cleared CFDs. This was done in accordance with the stated goal of EU financial authorities to increase the share of cleared OTC contracts.

In 2016, the European Securities and Markets Authority (ESMA) issued a warning on the selling of speculative products to retail investors. This warning also included the sale of futures contracts, and it listed CFDs as one of the items covered by the alert. After noting a rise in the marketing of these products concurrently with an increase in the number of complaints from retail investors who had experienced considerable losses, they decided to take action. This decision was made as a result of both of these observations.

According to MiFID, any provider situated in any member nation can provide the products to all member countries in Europe. In response to the warning, various European financial regulators enacted tighter limits on CFD trading. The majority of providers have their headquarters in either Cyprus or the United Kingdom, and the authorities in charge of regulating financial markets in both of those countries were among the first to react to the crisis. CySEC, the financial regulator in Cyprus, where many of the businesses are based, tightened the restrictions on CFDs in November of 2016, making a number of adjustments, including limiting the maximum leverage to 50:1 and barring the distribution of bonuses as sales incentives. Following this, on December 6, 2016, the Financial Conduct Authority (FCA) of the United Kingdom (UK) presented a proposal for similar limitations, which was eventually implemented.

This action was taken in response to this event. On the first of August 2019 and the first of September 2019, respectively, the Financial Conduct Authority (FCA) announced additional limits on contracts for difference (CFDs) and CFD-like options, with the maximum leverage being set at 30:1. In response to the warning issued by ESMA, the German financial regulator BaFin took a different approach and forbade extra payments in the event that a customer experienced a loss. The French financial markets regulator, the Autorité des marchés financiers, has placed a ban on advertising for CFDs in the country (Authority of Financial Markets). In March, the Irish financial authority followed suit. It released a proposal that would either ban CFDs in the country’s financial markets or establish limits on the amount of leverage that might be used.

The Energy Act of 2013 established contracts for difference (CFD) as a means of providing financial assistance to new low-carbon energy generation in the United Kingdom, such as that derived from nuclear and renewable resources. The previous Renewables Obligation program was gradually changed over to be replaced by Contracts for Difference (CFD). Instead of the price being decided through a process of auction, the price may be predetermined by the government in certain nations, such as Turkey.

CFD Trading and The Risks Associated with It

Trading in CFDs is a fast-speed activity that requires the trader to pay close attention at all times. As a consequence of this, investors who trade CFDs ought to be aware of the significant risks that they are taking when doing so.

There are risks associated with maintaining margins and liquidity, and if you are unable to cover value reductions, your provider may close your position. In this case, you will be responsible for the loss regardless of what occurs with the underlying asset. When you take on leverage risks, you expose yourself not just to the possibility of bigger possible earnings but also to the possibility of greater potential losses. Although many providers of CFDs make stop-loss restrictions available to their customers, these providers are unable to guarantee that you will not incur losses. This is especially true if the market is closed or if the price of the CFD experiences a significant shift.

The time lapses that occur between trades present another potential source of execution concerns. The Securities and Exchange Commission of the United States has decided to ban contracts for difference (CFDs) because there is insufficient oversight from regulatory bodies and the associated risks are high (SEC).

Liquidation Risk

In the event that prices move in the opposite direction of an open CFD trade, further variation margin is necessary in order to maintain the same margin level.

It is possible for the CFD providers to issue what is known as a margin call, in which they request that the party make an additional deposit of funds in order to cover the shortfall. Margin calls can be made at any time and without prior notice in markets that move quickly. If payments are not received in a timely manner by the CFD provider, the positions may be closed or liquidated, resulting in a loss that the other party is liable to compensate for.

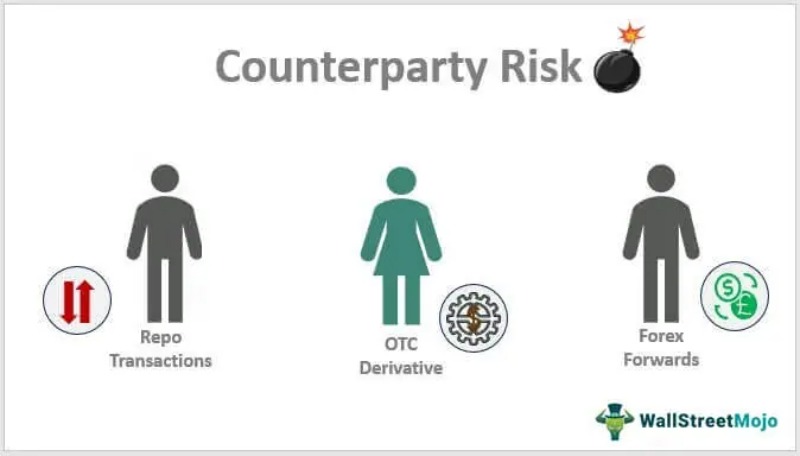

Counterparty Risk

The bulk of over-the-counter (OTC) derivatives have counterparty risk as one of their components; therefore, it is important to keep this facet of CFD risk in mind as well.

In the context of a contract, the term “counterparty risk” refers to the danger connected with the other party’s capacity to maintain their financial stability or solvency. Regardless of the underlying instrument that is being traded, the failure of the counterparty to a CFD contract to meet their financial commitments may result in the CFD contract having little or no value. In the real world, this indicates that even if the underlying instrument moves in the right direction, a trader in CFDs still stands a chance of incurring big losses regardless of the outcome of the transaction. OTC CFD providers are obligated to keep their customers’ funds in separate accounts in order to safeguard their balances in the event that the firm goes bankrupt; yet, incidents such as the one that occurred with MF Global serve to remind us that guarantees are not always kept.

It is generally accepted that the level of counterparty risk associated with exchange-traded contracts that are transacted via a clearing house is lower. At the end of the day, the degree of counterparty risk is defined by the credit risk of the counterparty, which may include the clearing house if one is present. This is the case because the credit risk of the counterparty is determined by the credit risk of the other party. The fact that custody is related to the company or bank that is responsible for providing the trading service in issue amplifies the risk that is associated with this circumstance.

If you have been scammed through online, then contact us to get your money back!

Market Risk

The principal risk associated with contract for difference trading is a market risk because of the nature of the trading instrument itself, which is designed to pay the difference in price between the opening price and the closing price of the underlying asset.

Due to the utilization of leverage, trading CFDs on margin results in an increase in both the potential for loss and the potential for gain. When it comes to trading CFDs, the typical client loses 74.38 percent of their capital, according to a study that was carried out by Saferinvestor in the year 2021. According to the estimates provided by the Financial Conduct Authority of the United Kingdom, the typical amount of money lost by each customer is close to $2,200. CFDs are used for speculative purposes on the movements of financial markets, and they are also used to hedge existing positions in other financial instruments.

This risk is precisely what motivates the usage of CFDs in either of these contexts. One strategy that can be utilized to mitigate the risks inherent in trading is the placement of stop-loss orders. Users will typically be required to make a predetermined cash deposit with the CFD provider in order to cover the margin. However, if the market goes against them, they stand to lose substantially more money than the amount they initially deposited. When looking at the overall leverage of a portfolio, an investment vehicle’s portfolio will often have features that compensate for the leverage that is inherent in CFDs.

This is because CFDs have a higher leverage than other financial instruments. This is especially true in the sector of the economy devoted to professional asset management. Maintaining cash positions in a portfolio, in particular, reduces the effective leverage of a portfolio. For instance, if an investment vehicle purchases 100 shares for $10,000 in cash, this provides the same exposure to the shares as entering into a CFD for the same 100 shares with $500 of margin and keeping $9,500 in cash reserves. Another way to look at this is to imagine entering into a CFD for the same 100 shares with $9,500 in cash reserves. This does not definitely indicate that higher market exposure will be the result of using CFDs in this case; nevertheless, it does imply that increased market exposure is a possibility (and where there is an increased market exposure, it will generally be less than the headline leverage of the CFD).

Advantages Associated with CFD Trading

Access to the Global Market Through a Single Platform

A great number of CFD brokers offer products in all of the major markets across the world, enabling their customers to trade at any time of the day or night.

Contracts for difference (CFDs) may be traded on such a wide variety of worldwide markets, investors have the opportunity to diversify the holdings in their portfolios.

Higher Leverage

Due to the characteristics of the market, CFDs provide greater leverage than more conventional forms of trading.

The CFD market is subject to regulatory regulation over the use of standard leverage. It used to be possible to have a maintenance margin of as little as 2 percent (with a leverage of up to 50:1). Still, today that number is confined to a range of 3 percent (30:1 leverage), and it may even go as high as 50 percent if certain conditions are met (2:1 leverage). As a result of reduced margin requirements, traders will have access to bigger potential returns while also incurring lower capital expenditures. A trader’s losses, on the other hand, have the potential to be magnified when using a higher level of leverage.

You Do Not Have to Deal with Shorting Rules or Borrowing Stock

There are some exchanges that have rules that prohibit short selling, require the trader to borrow the instrument before selling short, or have different margin requirements for short and long positions.

Some markets also have rules that require the trader to borrow the instrument before selling short. CFD instruments can be shorted at any time without the trader being responsible for paying any borrowing fees because the trader does not own the underlying asset.

Execution by A Seasoned Professional with No Fees

CFD brokers offer many of the same order types as traditional brokers, such as stops, limits, and dependent orders, such as “one cancels the other” and “if done.”

Examples of these order types include “one cancels the other” and “if done.” CFD brokers additionally provide clients with access to a broad range of additional order types, such as “if done.” Some brokers who offer guaranteed stops will charge a fee for the service or find another means to recoup costs in order to pay their expenses. Other brokers won’t offer guaranteed stops at all. A commission is given to the broker whenever a trader makes a payment toward the spread. They might assess commissions or fees on a periodic basis. If a trader wants to buy anything, they have to pay the ask price, but if they want to sell something or take a short position, they have to pay the bid price.

Depending on the volatility of the underlying asset, it is possible to trade with either a small or huge spread; fixed spreads are usually available.

There Are No Additional Requirements for Day Trading

To day trade in some markets, you need to have a certain minimum amount of money, and in other markets, there are limits on the number of trades that may be made in a given account within a certain amount of time and within a certain length of time.

The CFD market is not subject to these restrictions, and as a result, all account holders have the option to participate in day trading if they so desire. Even while the majority of banks need a minimum deposit of $2,000 or $5,000 to get things started, it’s possible to open a savings account for as little as $1,000 in some cases.

A Huge Variety of Trading Possibilities

CFDs are currently offered by brokers on a variety of asset classes, including stocks, indexes, treasuries, currencies, sectors, and commodities.

As a consequence of this fact, speculators interested in several financial instruments can trade CFDs as an alternative to trading on exchanges. These speculators can trade CFDs on a range of exchanges.

Disadvantages Associated with CFD Trading

Risk of Losing Huge Sums of Money

Contracts for difference offer an attractive alternative to traditional markets, yet, trading them comes with the possibility of incurring financial losses. Because of the requirement to pay the spread on both entry and exits, there is no longer any chance of making a profit from very insignificant shifts in the market.

When compared to the underlying asset, the spread has the effect of increasing losses and decreasing winning trades by a small amount, respectively. In addition, the spread has the effect of reducing winning trades by a small amount. As a consequence of this, whereas traditional markets subject traders to fees, rules, commissions, and greater capital requirements, CFDs diminish traders’ earnings by imposing spread costs on trades. In contrast, traditional markets subject traders to fees, regulations, and commissions.

Absence of Effective Industry Regulation

At the moment, the CFD market is not subject to a lot of regulation. The credibility of a CFD broker is established not by variables such as the status of the government or the liquidity of the market but rather by characteristics such as the reputation, longevity, and financial condition of the broker.

There are a number of CFD brokers on the market who provide good services; however, before creating an account with any broker, it is essential to do extensive research on the broker’s background.

Numerous Companies Have Been Blacklisted for Conducting CFD Trading Scams

The European Securities and Markets Authority (ESMA), which is the European equivalent of the Financial Conduct Authority (FCA), has mandated that all brokers who are regulated by the FCA must publish on their websites and in their marketing materials the percentage of clients who lose money when trading CFDs with them.

It is now more obvious than ever that products with a high level of investment risk are not appropriate for everyone. On the other hand, the sooner you strive to generate money, the sooner you must embrace the possibility that you may lose it just as quickly as you made it. This is because the faster you make money, the faster you risk losing it. Therefore, there is a significant level of risk associated with the product; nevertheless, it is also self-directed, and the only thing that is required is execution. Even if you are only giving implicit advice, the laws of the Financial Conduct Authority (FCA) specify that you are not allowed to give advice to customers about what they should invest in. This indicates that customers are accountable for deciding how they choose to invest their money on their own.

They are the ones that pulled the trigger by exposing themselves to the risk of experiencing a financial loss. This may be done in order to produce a greater commission for them on each deal, which is the goal in some instances. These are the kinds of cons that are performed in movies like “Wolf of Wall Street” and “Boiler Room,” for example. Scammers that deal in CFDs will, in the worst situations, seek to convince their victims to squander their money on purpose. Scam CFD brokers make money by purposefully encouraging their customers to deposit money and then losing money because they fail to hedge their customers’ positions. This cycle allows them to continue making money. This suggests that the deals are fraudulent and that they are functioning, in this case, more like a bookie than a broker.

Because it is now so easy to establish a brokerage that gives the impression of being legitimate and to utilize social media to attract customers to do business with them, the Financial Conduct Authority (FCA) has started to take action. Until recently, offshore CFD brokers were allowed to register for regulation in Cyprus and then be passported into the register maintained by the Financial Conduct Authority (FCA) in the United Kingdom. Therefore, potential customers have the ability to confirm the legitimacy of the businesses in question by searching them up on the website maintained by the Financial Conduct Authority (FCA).

As a consequence of this, it is not sufficient to check to see if a firm is regulated by the FCA in order to assess whether or not the company is operating a scam. One of the most effective weapons at a con artist’s disposal is the Fair Credit Reporting Act (FCA). Investors are more likely to be taken advantage of if a company gives the impression that it has been screened by the Financial Conduct Authority. The Financial Conduct Authority (FCA) is now taking action in an effort to prevent corporations based in Cyprus and offshore jurisdictions from gaining passporting privileges in the United Kingdom. However, con artists are crafty and good at manipulating people through covert or overt techniques. Therefore common sense should always triumph when it comes to dealing with cons. These golden guidelines should be kept in mind if trading CFDs is something you are considering doing in the future. If something looks like it’s too good to be true, there’s a strong chance it isn’t. You should never believe the claims made in lifestyle commercials because CFD brokers are not allowed to market their products in this manner.

These are almost certainly coming from affiliates who are making an effort to get you to enroll in their trading course or connect you to an offshore brokerage firm that is not subject to any regulations. Unannounced phone calls are a warning sign of an approaching threat. If you get a call from a pushy salesperson, you should hang up immediately and then report the offender to the appropriate authorities. Immediately, it should serve as a warning signal. As a result, not every call from a CFD broker is a scam, as there are legitimate brokers that do phone new customers to welcome them to the program.

There is, however, a significant distinction between receiving a call from someone who has invited you to do something and receiving a call from someone on a line that is noisy and advising that you can “earn a second income through FX trading.” There is no warning about the risk. If you come across adverts online that do not include a risk warning, you should refrain from clicking on those advertisements and report the ones that you see. People start to tune out legitimate advertisements and become more susceptible to being persuaded by advertisements that do not include a risk warning because of the requirement for risk warnings. This means that people begin to ignore legitimate advertisements. There is no regulation from the FCA. Even if the Financial Conduct Authority (FCA) is involved in an activity, this does not guarantee that it is not a scam. As an illustration of what we mean by this, just look at London Capital & Finance and their swindle involving 230 million pounds worth of mini-bonds.

Nonetheless, you should use it as a jumping-off point for the rest of your research that you conduct online. Never give in to the pressure from your peers. There is not a single reputable CFD broker in the world who would ever put you under any form of pressure to sign up for an account. There will be an end to the practice of constantly gaining and losing customers. It is in the best interest of reputable CFD brokers to cultivate long-term relationships with the knowledgeable traders who make up their clientele.

This is the simplest, basic, and widely accepted structure for commercial transactions that is currently available. It makes it possible for people from any country to take part in a variety of different financial markets all at the same time. Trading in the conventional approach has the drawback of limiting you to trading in a single market at any given time. This is one of the disadvantages of traditional trading. If, on the other hand, you register an account with an online CFD broker, you will have access to a wide variety of various financial markets from which to trade. Contracts for differences, also known as CFDs, are a type of derivative trading vehicle that enables traders to speculate on the value of underlying assets without actually exchanging the assets themselves.

Trading a contract for difference (CFD) does not result in the acquisition of ownership of the underlying asset. This entails that you will be able to place orders simultaneously in a number of different markets. There are many different marketplaces in which one can trade contracts for difference (CFDs), and some of the most well-known and widely traded CFDs include stocks, commodities, and indexes. In addition, there is a wide range of additional CFDs. Contracts for difference, often known as CFDs, are a type of financial derivative used in the world of finance. They give investors the ability to bet on the short-term fluctuation of prices. The opportunity to trade with leverage is only one of the many benefits that come along with engaging in contract for difference (CFD) trading.

Other benefits include the option to “go short” (sell) if you feel that prices will go down and “go long” (buy) if you believe that prices will go up. CFDs have a variety of benefits, not the least of which is that they do not call for the payment of stamp duty in the United Kingdom and are therefore tax-efficient there. Other advantages include the following: Please keep in mind that the tax treatment changes depending on individual circumstances and that the tax treatment may differ or vary in countries other than the United Kingdom. In addition, please keep in mind that the tax treatment varies based on individual circumstances. If the circumstances warrant it, CFD transactions can also be utilized as a means of hedging an existing investment portfolio in the real world.

On the internet and on social media platforms, there is a lot of advertising for scams that take advantage of online trading platforms. Con artists would often encourage people to take part in their scams by promising them enormous riches in exchange for their involvement. They will also use fake celebrity endorsements and pictures of expensive goods to entice others to participate. After that, the advertisements lead consumers to websites that look very professional, where they are encouraged to invest either by opening a managed account in which the firm trades on their behalf or by trading directly on the trading platform offered by the firm.

Key Takeaways!

Always trade in a comfortable environment and in a safe manner by choosing experienced forex brokers you can trust.

Utilizing the services of experienced forex brokers ensures that your money will never be put in jeopardy. Start turning actual money by choosing forex brokers that are recommended by the forex community.