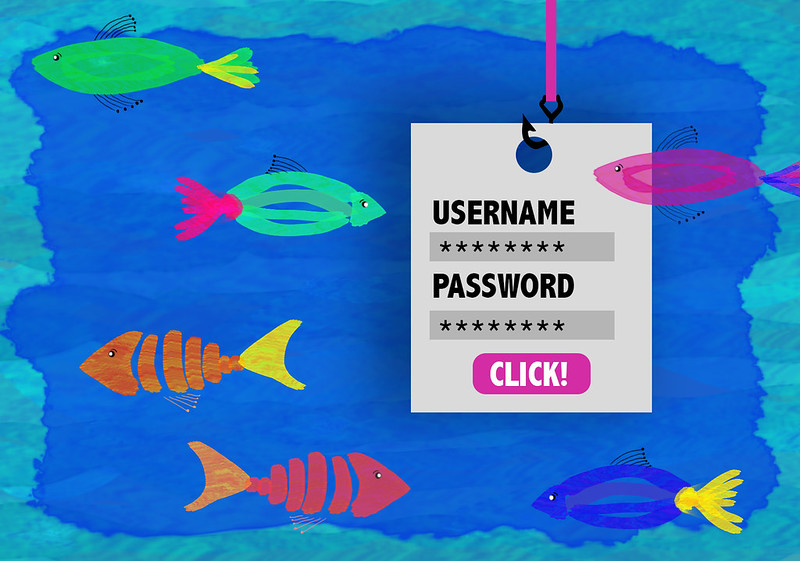

Looking for a reliable and strong financial company? Well, don’t believe everything you read on the internet because some companies that appear “authentic and reliable” on Google may just be a scam.

Our tracking experts have compiled a list of blacklisted banking scam firms to protect you from such con artists. Avoid these companies at all costs!!! You’re probably wondering what a blacklist is. It is a list of individuals, organizations, or countries who have been outcasted by others due to allegations of immoral or unethical behavior or activities. A blacklist is a form of retaliation that usually entails financial hardship for those who have been named on it. Those who have been placed on a blacklist may find it difficult to do business

Although blacklisting has a long history, governments are increasingly using it to ensure the efficiency of economic sanctions by publicly identifying organizations and countries to avoid. Since the 1610s, the term “blacklist” has been used. A person who was on a blacklist was suspected of something and should be avoided. A blacklist of workers suspected of being involved in union organizing had been circulated to potential employers by the late nineteenth century. The goal was to both silence and punish unionists. A blacklist can now be created by any type of organization, from a political or religious group to a commercial or professional one.

It could be made public to increase pressure on those on the list, or it could be sent out in confidence to those who could use the information to cut ties with those on the list.

Personal details should not be discussed. Scammers could gain access to almost every aspect of your life if they have the right information. This includes both your identity and your money and other accounts being stolen. Never give out personal information, such as account numbers, Social Security numbers, credit card numbers, or passwords to strangers unless you know who they are and the request is legitimate.

Deutsche Bank Trust And Finance (AG)

In the Americas, Deutsche Bank is a leading financial services provider to agencies, corporations, governments, private individuals, and institutions.

The bank began independent operations in the United States in 1978, opening its first North American branch in New York City, after first establishing a presence in the Americas in the nineteenth century. Deutsche Bank was the first German bank to list on the NYSE in October 2001, and it is now one of New York City’s largest foreign-based employers.

On July 1, 2016, Deutsche Bank established DB USA Corporation, a US intermediate holding company through which the majority of its US-based operations were consolidated as required by the Dodd-Frank Act.

At Deutsche Bank, there have been numerous scandals. Since 2008, it has paid more than $9 billion in fines and settlements for offenses such as conspiring to manipulate the price of gold and silver, defrauding mortgage companies, and trading in Iran, Syria, Libya, Myanmar, and Sudan in violation of US sanctions. For its role in manipulating the London Interbank Offered Rate, or libor, which is the interest rate banks charge one another, Deutsche Bank was ordered to pay two and a half billion dollars to regulators in the United States and the United Kingdom, as well as dismiss seven employees, last year. In the United Kingdom, the Financial Conduct Authority chastised Deutsche Bank not only for its libor manipulation, but also for its subsequent lack of candor.

The F.C.A.’s Georgina Philippou stated, “Deutsche Bank’s failings were compounded by them repeatedly misleading us.” “The bank took far too long to produce critical documents and to fix relevant systems.”

US Mortgage Transactions

Subprime loans are thought to be the root of the global financial crisis. Above all, it was Deutsche Bank that purchased the poorly secured mortgages from US home buyers, wrapped them in highly complex financial products, slapped top ratings on them, and sold them to other banks as safe investment products. The bonds were instantly worthless when the market crashed.

Meanwhile, Deutsche Bank had long predicted a crash and profited handsomely from it. The bank received its first penalty in 2013, when it was ordered to pay $1.9 billion to the then-nationalized US construction finance companies Freddie Mac and Fannie Mae. In 2017, the bank reached an agreement with US authorities.

Initial talks were for $14 billion, which would have put Deutsche Bank on the verge of bankruptcy. The bank ultimately paid $7.2 billion.

The FCPA Case

Between 2009 and 2016, Deutsche Bank knew about and purposefully conspired to keep false books, documents, and accounts to conceal, among other things, payments to a (BDC) long for corporate development advisor who was acting as a surrogate for a foreign official and monies to a BDC that were primarily bribes paid to a foreign official, according to admissions and court documents.

Deutsche Bank made payments to BDCs that were not backed up by invoices or other documentation for services rendered in some cases. In other cases, Deutsche Bank employees set up bogus payment explanations or assisted BDCs in doing so.

Employees of Deutsche Bank worked with a firm owned by a client decision maker’s wife to arrange $1 million in bribe payments to the decision maker in connection with a Saudi BDC, according to the bank.

Despite Deutsche Bank employees seeing the relationship between the Saudi BDC and the decision-maker, and despite Deutsche Bank employees publicly acknowledging the need to pay the Saudi BDC to reward her spouse for continuing to do business with Deutsche Bank, the BDC partnership was allowed. When asked for permission to make a single payment, Deutsche Bank representatives stated that the “client and [the Saudi BDC] are tightly entwined, and any cessation of payment to the will undoubtedly result in a significant outflow of [business]” from the customer.

The fact that Deutsche Bank staff were aware that the Abu Dhabi BDC lacked BDC qualifications and was acting as a proxy for the client decision-maker, the Abu Dhabi BDC was used to secure a lucrative transaction. The Abu Dhabi BDC received more than $3 million from Deutsche Bank without receiving any bills. In violation of the FCPA, Deutsche Bank conspired to falsify the bank’s books, papers, and accounts by agreeing to fabricate the purpose of payments to BDCs and misrepresenting payments to others as payments to BDCs.

Furthermore, Deutsche Bank employees knowingly and intentionally violated the FCPA by failing to conduct thorough research on BDCs, paying bills to BDCs who were not under contract with Deutsche Bank at the time, and paying bills to BDCs without receipts or adequate documentation of the allegedly performed services, among other things. In connection with the FCPA scheme, Deutsche Bank will pay a total penalty of $79,561,206. Deutsche Bank agreed to pay the Securities and Exchange Commission $43,329,622 in disgorgement and punitive discrimination in a separate complaint.

The Commodities Fraud Case

According to court documents and admissions, Deutsche Bank precious metals dealers conspired to defraud other traders on the C.M.E. Group Inc.’s commodities exchanges, the New York Mercantile Exchange Inc. and the Commodity Exchange Inc., between 2008 and 2013.

On multiple occasions, traders on Deutsche Bank’s precious metals desks in New York, Singapore, and England placed orders to buy and sell precious metals futures contracts with the intent of canceling them before they were executed, including in an attempt to profit by deceiving other market participants by injecting false or misleading information about the existence of genuine market forces for precious metals commodity futures.

On September 25, 2020, a federal jury in Chicago found two former Deutsche Bank precious metals dealers, James Vorley, 42, of the UK, and Cedric Chanu, 40, of France and the United Arab Emirates, guilty of their roles in the commodities conspiracy. David Liew, 35, of Singapore, a third former Deutsche Bank trader, pled guilty to wire fraud and spoofing conspiracy on June 1, 2017. Edward Bases, 58, of New Canaan, Connecticut, was found guilty of fraud and conspiracy in a third superseding indictment on November 12, 2020, and is currently awaiting trial. A charge is all that is contained in an indictment, and all defendants are presumed innocent until proven guilty beyond a reasonable doubt in court.

Deutsche Bank agreed to pay a total criminal penalty of $7,530,218 in connection with the commodities scam. This total includes $681,480 in criminal forfeiture, $1,223,738 in survivor compensation payments, and a $5,625,000 lawbreaker penalties, all of which were fully offset by Deutsche Bank’s $30 million civil financial fine to a Us Commodity Futures Trading Commission for substantially the same commodities conduct in January 2018.

The Department of Justice reached this agreement with Deutsche Bank based on a number of factors, including the firm’s failure to purposefully and willingly disclose the conduct to the division, as well as the scope and nature of the offense, which included shady pay – outs, willful violations of FCPA financial information provisions, and commodity trading infringements in three countries.

Deutsche Bank was given full credit for cooperating with the department’s investigations and demonstrating significant rehabilitation. Penalties related to both the FCPA and wire fraud conspiracies receive a 25% reduction off the center of the typically relevant US Sentencing Guidelines fine range to reflect Deutsche Bank’s 2015 settlement in connection with the rigging of the London Interbank Offered Rate.

Money Laundering in Russia

While negotiations with US authorities were ongoing, another, much smaller, Deutsche Bank scandal emerged in 2015.

According to the findings of the investigators, the bank used stock transactions to launder $10 billion in dirty money in Russian rubles. Because the transactions were in US dollars, US authorities stepped in once more. This time, the fine is $600 million. Deutsche Bank later discontinued its investment banking operations in Russia..

Interest Rate Manipulation

The abbreviations Euribor and Libor refer to specific reference interest rates.

The Euro Interbank Offered Rate (Eurobor) specifies the interest rates at which European banks can lend to one another in euros. Libor (London Interbank Offered Rate) serves as the basis for certain types of financial transactions, such as derivatives or mortgages. The European Commission fined six major international banks €1.7 billion in 2013 after traders manipulated interest rates. Deutsche Bank paid the largest fine of €725 million and was later fined another $2.5 billion by British and US authorities.

Violations of The US-Iran Embargo

The fines Deutsche Bank had to reimburse after US authorities said it had infringed an existing US embargo on Iran were much lower. The bank paid out $260 million in 2015, much less than the $1.4 billion paid out by Deutsche Bank rival Commerzbank over similar allegations.

Relationship With Jeffery Epstein

“Taking on Jeffrey Epstein as a client in 2013 was a huge mistake.”

This was Deutsche Bank’s meek reaction after the New York State Department of Financial Services (DFS) imposed a $150 billion financial penalty on the bank. The advisory body claimed that despite knowing about Epstein’s “horrible criminal past,” Deutsche Bank did nothing about the “regular, suspicious withdrawals.” The transactions were also linked to minors’ sexual abuse. In August of 2019, the convicted sex offender and billionaire committed suicide in prison.

Danske Bank

As the correspondent bank of Danske Bank, Deutsche Bank was also involved in one of the world’s largest money laundering scandals.

Between 2007 and 2015, suspicious transfers totaling approximately €200 million passed through the Danish bank’s branches. DFS accused the bank of “inadequate oversight of its customers” once more. Since then, Deutsche Bank has invested nearly a billion dollars in improving internal auditing, adding over 1,500 new employees to the oversight department.

Share Price Crash

The bank’s reputation has suffered as a result of the recent scandals. Its share prices, and thus its market value, are at rock bottom.

In the last ten years, shares have lost roughly 75% of their value. They’ve lost 85 percent in 20 years. The bank’s current market capitalization is €16 billion. Only those who purchased their first Deutsche Bank shares this year can rejoice in a 25% gain.

Lost money to online fraud? We will recover your funds !

EURO-SWISS FINANCE AND SECURITIES (ESFS) GROUP

The aforementioned entity is not a company formed under the laws of the Isle of Man.

It is not registered on the Isle of Man as a foreign corporation with a place of business. On the Isle of Man, it is not a registered business name.

What Are Their Claims?

The following statements were released by the financial services authority:

- The Commission was recently made aware of the aforementioned website, which includes references to and purports to represent the aforementioned entities.

- According to the website, the above organizations have been licensed by the Isle of Man Financial Supervision Commission. The Financial Supervision Commission can state unequivocally that the entities listed above are not, and have never been, licensed to conduct banking, investment, or corporate service provider activities in or around the United States.

- The above entity is not a company formed under the laws of the Isle of Man. It is not registered as a foreign corporation with a place of business on the Isle of Man. It is not a registered business name on the Isle of Man.

- The Commission has discovered no connection between this corporation and any legitimate business.

- There is no connection between this corporation and any legitimate Isle of Man business, according to the Commission.

- According to the Commission, there are no actual links between this entity and the Isle of Man.

- The Jersey Financial Services Commission has issued a public statement regarding the aforementioned website and related organizations, which is available on their website. The Euro-Swiss Finance and Securities (ESFS) Group is also listed on the UK Financial Services Authority’s website as an unlicensed internet bank.

- Given the circumstances, the Commission strongly advises anyone thinking about doing business with this firm to proceed with extreme caution, keeping the contents of this public notice in mind.

Why Did It Get Blacklisted?

Avoid financial products from the Euro-Swiss Finance and Securities (ESFS) Group, which claims to be approved by the Isle of Man Authority, which has flatly denied the document’s credibility.

Furthermore, the company has been added to a list of internet banking service providers that are operating without the necessary UK supervisory authority authorization.

1ST GULF INTERNATIONAL (AKA FIRST GULF INTERNATIONAL)

Gulf International Bank B.S.C. (G.I.B.) was established in 1975 and began operations in the Kingdom of Bahrain in 1976. G.I.B. opened its first representative office in London in 1978, which later became a full branch in 1979. In 1980, it established the first branch of any Arab bank in the United States in New York. In the 1980s, G.I.B. shifted its focus to the Gulf Cooperation Council (G.C.C.), attracting capital to the region by partnering with top international organizations to finance large infrastructure projects.

G.I.B. opened representative offices in Abu Dhabi, UAE (which became an entire wholesale commercial branch in 2015) and Beirut, Lebanon in 1994 to support its regional activities, attracting business from Middle Eastern markets in the Levant and lower Gulf to its Bahrain hub while also servicing clients in Lebanon and the UAE. In 1999, G.I.B. purchased the London-based Saudi International Bank (S.I.B.) and renamed it Gulf International Bank (U.K.) Limited in order to create a broader, more diverse banking organization. G.I.B. (U.K.) is G.I.B.’s wholly-owned subsidiary that currently manages the company’s assets.

G.I.B. was the first non-Saudi bank to be granted a branch license in the Kingdom of Saudi Arabia in 2000, when it opened a branch in Riyadh. Following that, G.I.B. opened a second Saudi branch in Jeddah, in the country’s western region, in 2005. G.I.B. opened its third Saudi branch and Country Head Office in Al Dhahran in 2014. G.I.B. was the first foreign-domiciled bank to be granted a local commercial banking license in the Kingdom of Saudi Arabia in 2017, marking yet another historical milestone. G.I.B. completed the conversion of its current branches in Saudi Arabia into a domestically established bank in April 2019. This new company, G.I.B. Saudi Arabia, is the country’s first foreign bank to be domestically incorporated.

Is Gulf Bank International a Legit Company?

Following approval from the Saudi Council of Ministers in May 2017, the bank will now operate as Gulf International Bank Saudi Arabia (G.I.B. Saudi Arabia), a fully-fledged local bank providing comprehensive banking and financial services throughout the Kingdom.

G.I.B. Saudi Arabia is owned equally by the Saudi Public Investment Fund (P.I.F.) and G.I.B. with a paid-up capital of SR7.5 billion and a mission or strategy to further improve and build the bank’s presence and levels of service in the critical Saudi market.

G.I.B. Capital L.L.C., a wholly-owned subsidiary, was established in 2008, significantly strengthening G.I.B.’s Saudi Arabian footprint. Using its parent’s investment banking expertise and experience, G.I.B. Capital provides a wide range of creative and personalized solutions to corporates, family businesses, entrepreneurs, governments, and quasi-governmental entities seeking loan and equity financing.

In 2010, G.I.B. repositioned itself as a prominent pan-GCC universal bank, and its retail banking arm,’meem by G.I.B.,’ began retail banking services in Saudi Arabia in 2014. meem offers technologically advanced online and mobile banking services. G.I.B. employs over 1,000 people globally and provides wholesale, treasury, asset management, investment banking, retail banking, and Shariah-compliant banking services through its global network of branches.

The Saudi Public Investment Fund owns 97.2 percent of G.I.B., which is owned by the governments of the six G.C.C. countries.

Almost all organizations and individuals in the United Kingdom that offer, promote, or sell financial services or products must be authorized or registered with the Financial Conduct Authority. The F.C.A. does not regulate this company, which is aimed at people in the United Kingdom. If something goes wrong or you are scammed, you will not have access to the Financial Ombudsman Service or the (FSCS), also known as the Financial Services Compensation Scheme, and you will be unlikely to receive your money back. Keep in mind that some businesses may provide additional information or change their contact information, such as email addresses, phone numbers, or physical addresses, over time.

Why Did It Get Blacklisted?

Falsely claiming to be affiliated with Gulf International Bank (US) Limited in New York City or Gulf International Bank (UK) Limited in London, England.

Fitch Ratings has affirmed Gulf International Bank – Saudi Arabia (G.I.B. S.A.Long-Term )’s Issuer Default Rating (IDR) at ‘BBB+’ with a Negative Outlook. Given significant, albeit diminishing, external reserves, Fitch sees the authorities as having a strong ability to keep the banking system running. It also demonstrates a long history of support for Saudi banks, regardless of their size, franchise, funding structure, or level of government ownership. We see a high risk of contagion among domestic banks due to the market’s small size and interconnectedness.

This, we believe, strengthens the state’s motivation to assist any Saudi bank in need in order to maintain market trust and stability. Moody’s Investors Service (Moody’s) recently confirmed Gulf International Bank’s (G.I.B.) independent benchmark credit assessment, long-term deposit, and short-term ratings.

Moody’s confirmed G.I.B.’s Prime-2 short-term and Baa1 long-term deposit ratings, but changed the outlook from ‘under review for downgrade’ to ‘negative.’ The bank’s standalone baseline credit rating remained at ba1. Moody’s believes that “the bank’s standalone profile will remain resilient despite the adverse environment, given the bank’s excellent asset quality indicators, capital, and liquidity buffers.” “G.I.B.’s asset quality profile is good and has been improving,” Moody’s said in a statement. The capital, as well as the bank’s funding and liquidity profiles, all influenced the ratings’ confirmation.

The Parameters of This Banking Scam

Gulf International Bank, headquartered in Bahrain, recently completed a $625 million sustainability-linked multilateral loan, which was widely oversubscribed in global markets.

According to G.I.B., which is owned by the Public Investment Fund, the facility was initially set at $500 million, but applications totaled $1.1 billion. More than 20 global investors from the United States of America, Asia, the Middle East, and Europe participated in the transaction, which includes environmental, social, and governance measures.

AB SUISSE

Credit Suisse Group AG, headquartered in Switzerland, is an international investment bank and financial services provider.

It is one of the world’s major “Bulge Bracket” banks, with offices in all major financial centers. It has its headquarters in Zürich and provides investment banking, private banking, asset management, and shared services. It is well-known for upholding banking secrecy and strict bank–client confidentiality.

It has been designated as a systemically important bank by the Financial Stability Board. Credit Suisse was founded and began operations in 1856 to aid in the expansion of Switzerland’s rail network. It provided loans to help build the Swiss electrical grid and the European train system.

In the 1900s, it began to focus on retail banking due to the massive rise in the middle class and competition from fellow Swiss banks UBS and Julius Bär. Credit Suisse formed a partnership with First Boston in 1978 before acquiring a majority stake in the bank in 1988.

Between 1990 and 2000, the corporation acquired Winterthur Group, Swiss Volksbank, Swiss American Securities Inc. (SASI), and Bank Leu. Credit Suisse’s largest institutional shareholders include the Qatar Investment Authority, mutual fund providers Harris Associates and Dodge & Cox, the Norwegian central bank, and the Saudi Arabian Olayan Group.

The company was one of the least affected by the global financial crisis, but it soon began reducing its investment operations, laying off employees, and cutting costs. From 2008 to 2012, the bank was the subject of various international tax evasion investigations, which resulted in a guilty plea and a US$2.6 billion fine. In 2021, Credit Suisse’s assets were worth CHF 1.6 trillion. Credit Suisse has been embroiled in a number of scandals involving client selection and climate change, most notably its support for Russian oligarchs during Russia’s invasion of Ukraine in 2022.

Is AB SUISSE a Legit Company?

Credit Suisse Group AG is a Swiss joint-stock company that operates as a holding company. It owns the Credit Suisse bank as well as other financial institutions. Credit Suisse is managed by a board of directors, stockholders, and independent auditors.

The Board of Directors organizes the annual General Meeting of Shareholders, but the agenda is set by investors with significant shares in the company. Shareholders choose auditors for one-year terms, vote on the annual report and other financial statements, and exercise other legal rights.

Board members are elected by shareholders for a three-year term based on candidates proposed by the Chairman’s and Governance Committee, and the Board of Directors meets nearly six times a year to vote on company resolutions. The Board of Directors develops Credit Suisse’s business strategies and approves its compensation policies based on input from the compensation committee. It can also form committees to delegate certain management responsibilities.

Why Did It Get Blacklisted?

A massive leak from Credit Suisse, one of the world’s largest private financial institutions, has revealed the hidden wealth of clients involved in torture, drug trafficking, money laundering, corruption, and other major crimes.

The breach, which reveals the identities of recipients of more than 100 billion Swiss francs (£80 billion)* held by one of Switzerland’s most well-known financial institutions, includes data on 30,000 Credit Suisse clients worldwide. Despite repeated promises to screen out problematic clients and criminal assets over decades, the leak reveals widespread Credit Suisse due diligence failures.

The Parameters of This Banking Scam

Among them are a human trafficker in the Philippines, a bribery-charged Hong Kong stock market executive, a billionaire who ordered the assassination of his Lebanese pop star lover, executives who robbed Venezuela’s state oil company, and corrupt politicians from Egypt to Ukraine.

One of the Vatican’s accounts was used to spend €350 million (£290 million) on an allegedly fraudulent investment in London real estate, which is the subject of a criminal trial involving several defendants, including a cardinal. An anonymous whistleblower provided extensive banking data to the German publication Süddeutsche Zeitung. The whistleblower source stated in a statement, “I believe that Swiss banking secrecy regulations are immoral.” “The excuse of protecting financial privacy is merely a fig leaf for Swiss banks’ heinous role as tax evaders’ accomplices.” Credit Suisse stated that strict Swiss banking privacy regulations prevented it from responding to specific client allegations.

According to a statement issued by Credit Suisse, the charges and inferences about the bank’s alleged business practices are based on “picked facts taken out of context, resulting in tendentious interpretations of the bank’s business activity.” According to the bank, the claims are mostly historical in nature, referring to “rules, practices, and expectations of financial institutions that were significantly different from where they are now.”

Despite the fact that some accounts in the data date back to the 1940s, more than two-thirds of them were created since 2000. Many of them remained open well into the previous decade, and some are still in use today. In 2009, the International Emergency Economic Powers Act and New York State Law were violated. From 1995 to 2006, the United States Department of Justice reported that it had reached an agreement with Credit Suisse regarding allegations that the bank assisted residents of International Emergency Economic Powers Act sanctioned nations in sending funds in violation of the Act and New York law. As part of the settlement, Credit Suisse agreed to forfeit $536 million.

Forex Manipulation, 2013

The European Union Commission on Competition fined Credit Suisse €83.3 million in 2021 for FX rate manipulation as part of a cartel that harmed E.U. customers and included several other prominent international banks.

U.S. Tax Fraud Conspiracy, 2014

In 2014, Credit Suisse admitted to conspiring with Americans to file false tax returns. Credit Suisse was fined $2.6 billion and ordered to make amends.

Malaysia Development Berhad Scandal, 2015

In September 2015, Hong Kong police launched an investigation into $250 million in Credit Suisse branch deposits in Hong Kong linked to former Malaysian Prime Minister Najib Razak and the sovereign wealth fund 1Malaysia Development Berhad (1MDB).

Singapore fined Credit Suisse S$0.7 million (£0.4 million, $0.5 million, €0.45 million) in 2017. According to Reuters, “in May 2017, Swiss financial watchdog FINMA… conducted “extensive inquiries” into Credit Suisse’s contacts with 1MDB.” In 2019, Credit Suisse was the subject of a FINMA complaint.

Mozambique Secret Loans Scandal, 2017

Between 2012 and 2016, Credit Suisse arranged US$1.3 billion in loans with Mozambican Finance Minister Manuel Chang to help the country’s tuna fishing sector grow.

The loans were made in the form of bonds, with the proceeds from tuna fishing and the country’s burgeoning natural gas industry used to repay them. Chang duped investors, his own government, the IMF, and the banks that provided the loans, including Credit Suisse. The United Kingdom, the United States, and European regulators fined Credit Suisse over $500 million for a lack of transparency in the bond’s issuance, kickbacks to Credit Suisse bankers, and allowing loans that were likely to be embezzled by Mozambican officials, including Chang. In October 2021, Credit Suisse pled guilty to wire fraud and agreed to cancel Mozambique’s debt of US$200 million.

U.S. Foreign Corrupt Practices Act Violation, 2018

On July 5, 2018, Credit Suisse agreed to pay a $47 million fine to the US Department of Justice and a $30 million penalty to the US Securities and Exchange Commission. (S.E.C.).

According to the SEC investigation, the banking firm violated the Foreign Corrupt Practices Act by hiring and promoting over a hundred Chinese officials and related personnel in order to gain banking and investment business in the Asia-Pacific region.

FIRST ATLANTIC CHARTERED BANK LTD

First Atlantic Bank is a Ghanaian full-service commercial bank with over 25 years of experience. First Atlantic Bank, which began as a merchant bank, evolved into a universal bank with a broader product offering in 2011. They’ve received numerous awards for their work in customer service, trade finance, and corporate banking.

They excel in retail, corporate, and institutional banking, as well as private banking and electronic banking. Each category offers a variety of one-of-a-kind services designed to make our customers’ lives easier. Their business model is based on building long-term relationships with our stakeholders in order to provide true value to all. They believe in your goals and desires. They are aware of your difficulties and frustrations.They are also ready to assist you in growing your potential in Africa.

The bank began as a commercial bank in 1995, primarily serving Accra. The Bank of Ghana granted it universal bank status in 2011. The Bank of Ghana issued an order in September 2017 mandating that all Ghanaian universal banks increase their required capital reserves from GHS 120 million (US$22.8 million) to GHS 400 million (US$73.4 million). First Atlantic Bank and Energy Bank Ghana merged in December 2018 to meet the Bank of Ghana’s revised capital criteria. The merged company was still known as First Atlantic Bank (Ghana) Limited. Mr. Amarquaye Armar is the chairman of the nine-member board of directors. Odun Odunfa is the managing director and chief executive officer.

You are most likely operating a financial firm in the United States without permission. Tennessee has yet to receive permission to operate.

The parameters of this banking fraud

In the largest scam involving the First Atlantic licensed bank, scammers used the bank’s name and sent emails to customers.

The following email was shared on the official Facebook page. The First Atlantic Bank management would like to bring to the public’s attention a bogus Facebook account called “Moni Atlantic” that is impersonating our logo and defrauding clients in a bogus predict and win program.

We want to be clear that this Facebook account has nothing to do with First Atlantic Bank and was not hired to run a lottery on its behalf. The general public, clients, and social media followers should avoid the “Moni Atlantic” Facebook account.

Don’t give them any of your personal information, bank account details, or money. The bank will not be held liable for any losses incurred as a result of the schemes of these con artists. Please be advised that First Atlantic Bank will not participate in any official program unless appropriate information is made available on its official social media handle, First Atlantic Bank.

APEX DEVELOPMENT BANK PLC

Apex Development Bank Ltd. was formed by the merger of M/s Royal Merchant Banking & Finance Ltd., M/s Rara Bikas Bank Ltd., and M/s Api Finance Ltd., and is a national development bank established under the Bank & Financial Institutions Act 2063 and the Company Act 2063.

The company’s promoters include some of Nepal’s most powerful and well-known industrialists, businessmen, and bankers.

Why Did It Get Blacklisted?

The haphazard credit disbursement that exposed the long-suspected counterintuitive practice of ‘evergreening’ bad loans in the banking sector, which has the potential to contaminate and even bring down the entire financial sector, has revealed the long-suspected counterintuitive practice of ‘evergreening’ bad loans in the banking sector.

When the Nepal Police’s Central Investigation Bureau (C.I.B.) detained over a dozen employees 10 days ago for their roles in a Rs1.5 billion scam involving the financial organization, the development bank’s unethical and unprofessional practices were exposed.

The arrestees were accused of stealing money by extending credit on the basis of insufficient collateral. Surprisingly, a loan restructuring directive approved by the development bank’s board of directors on September 13, 2015, included a provision allowing management to disburse new loans to settle outstanding credit, according to an on-site inspection report written and presented by Nepal Rastra Bank (N.R.B.), the banking sector regulator, and obtained by the Post. This means that the bank’s board of directors, whose responsibility it is to ensure good governance, gave management permission to evergreen the loan book. Evergreening occurs when banks make new loans to borrowers who are unable to pay their debts on time.

The new loan is then used to pay off the old loan installments. This practice is contradictory because it prevents banks from making good loans by diverting available funds to borrowers with bad loans. This creates a vicious cycle in which the financial institution eventually finds itself unable to make good loans, putting pressure on the capital adequacy ratio, a measure of a bank’s ability to disburse credit.

Apex Development Bank has been engaging in this deception for a long time. According to the report, which was required to submit to the N.R.B. on January 12, 2017, or a month after the renewal of final approval for the merger between N.C.C. Bank and Apex Development Bank, this is evident from the practice of issuing loans to the same group of borrowers and diverting credit to the same group via other borrowers.

The disbursement of a Rs50 million demand and working capital loan to Aditi Enterprises on October 16, 2015, based on inflated assets, is one example of this fraud. The loan was approved on the same day the bank received the collateral value documentation, which is unusual.

The so-called demand and working capital loan was never used for its intended purpose. The money was instead used to compensate other parties, including Myanglung Housing, which had received Rs22.4 million, according to the investigation. On the same day, Myanglung Housing received another Rs70 million loan from the bank, according to the report.

Companies such as Myanglung Housing, Aditi Enterprises, Arohan Housing and Agricultural Firm, Arunima Housing, and Om Multipurpose Industries, according to the research, either borrowed directly from the bank or were end consumers of many of the bank’s loans. According to the study, the bank made house loans worth Rs125.4 million to 35 “dummy borrowers” who transferred the funds to the accounts of Upen Newang, Pandav Nepal, and others. “This suggests that money was being funneled to a small number of borrowers, allowing the evergreening of problematic loans,” said a senior N.R.B. official on condition of anonymity.

The seeds of Apex Development Bank’s evergreening of bad loans were apparently sown long before the institution was founded. Apex was formed by the merger of Royal Merchant Banking and Finance Limited, Rara Bikas Bank, and Api Finance. Royal Merchant’s credit of Rs1.15 billion was in doubt at the time of the merger. This was because loans were made against subpar collateral and without a thorough examination of the assets pledged as security.

As a result, the capital adequacy ratio was 12.5 percent lower than the minimum of 11 percent. When the N.R.B. performed a routine inspection of the bank in January 2014, it appeared that the malpractices that had eroded the bank’s balance sheet had gone unnoticed. These flaws were also overlooked when the N.R.B. conducted a special audit of the bank with the assistance of KPMG, one of the world’s big four auditors.

The KPMG assessment, a copy of which was provided to the Post, did identify several risk factors for the bank, including its use of revolving credit lines, credit risk associated with its credit portfolio, and the recoverability of real estate assets. Certain credit exposures were not effectively managed, according to the December 2015 report.

It has, however, not issued any kind of warning.

What’s more, a due diligence audit (D.D.A.) performed during the merger of Apex and N.C.C.

Bank, as well as another D.D.A. performed during the merger of Royal Merchant, Rara Bikas Bank, and Api Finance, failed to uncover these irregularities. “When cosmetics are used, it makes it more difficult to track wrongdoing,” the N.R.B. official explained. “However, the central bank is concerned about these incidents and will increase surveillance to catch these fraudulent activities,” the statement says.

What Were The Parameters of This Banking Scam?

According to official sources, the Arunachal Pradesh government has fired 28 employees of the state-owned Cooperative Apex Bank and filed criminal charges against individuals found guilty of approving loans totaling Rs 200 crore indiscriminately in connection with the scandal. 19 senior bank executives have been suspended, according to the sources, and borrowers have been given a month to clear their outstanding debts or face legal action.

Chief Minister Dorjee Khandu announced the formation of a committee, chaired by independent M.L.A. R K Khirmey, to devise a process for establishing the bank. The state government did receive a cheque for Rs 225 crore from the National Hydroelectric Power Corporation on June 24 as a deposit for three hydropower projects, according to reports.

Due to a liquidity crisis caused by indiscriminate loan disbursement, the bank, which has 32 branches across the state, has been closed for the past two years. The bank was set to reopen in a few days, with normal operations resumed in the first week of August.

FORD FINANCIAL SERVICE

Ford Financial Services, Inc. (“FFSI”) is a commercial equipment lending company based in California. As a Direct Lender, FFSI underwrites transactions, records deals, and funds equipment suppliers in-house and on time.

FFSI is a credit-based lender with the ability to help you finance almost any type of commercial machinery. Several of the country’s largest banks, accounting firms, and equipment manufacturers use FFSI’s services. Making connections is more important to us at FFSI than making sales. Ford Motor Credit filed more paperwork with the bankruptcy court on Friday morning, claiming that this is one of the largest floor-plan financing frauds in US history.

According to the documents, Reagor-Dykes Auto Group hid the “serious breach” from Ford Credit by fabricating sales-reporting data. Reagor-Dykes was thought to be paying off cars it sold to the general public on time, but Ford Credit discovered that the company was selling cars 55 days before they were reported to them. It’s known as a check-kiting scheme. Reagor-Dykes was also accused of fraudulently obtaining double-flooring through Ford Credit, according to the complaint. Double-flooring is an illegal technique in which a single vehicle is used as collateral for multiple loans. It occurs when a car dealer secures financing for the same vehicle twice.

According to Ford Credit, Reagor-Dykes allegedly obtained inventory credit for cars it had already sold by telling Ford Credit that the car was still available for purchase and then obtaining more financing. According to the corporation, current management has also been involved in fraudulent vehicle double-flooring. According to Ford Credit, this isn’t just a contract breach; it’s also loan fraud. It is a crime punishable by years in prison if proven to be true.

Is This a Credit Union or a Bank?

Banks and credit unions are distinguished from one another by their profit status. Credit unions, on the other hand, are not for-profit businesses that are either privately held or publicly traded.

This profit vs. non-profit divide is responsible for the disparity in products and services offered by each type of institution. The members of a credit union own the institution because it is set up as a cooperative. Individuals who share a common bond, such as their profession, their community, their faith, or their affiliation with another organization, are usually eligible to join credit unions.

Credit unions are nonprofits, they are usually exempt from federal taxes, and some credit unions even receive subsidies from the organizations with which they are affiliated. Credit unions will no longer have to worry about making a profit for their shareholders. The credit union’s mission is to provide the best possible terms on financial products to its members. This means that members typically get better annual percentage yields on savings products, pay fewer (and lower) fees, and get lower lending rates than bank clients. Banks, on the other hand, are in the business to make a profit.

This indicates that banks are more concerned with making a profit than with meeting account holders’ needs. This is one of the reasons why banks charge higher fees and process transactions more quickly than credit unions. Bank lending interest rates are also higher, while savings product annual percentage yields are lower. While credit unions’ non-profit status and member-centric focus make them appear to be the clear winner when compared to banks, consumers may choose banks for a variety of reasons.

To begin with, banks are willing to work with any customer who is interested in a product or account, as long as the customer has a good credit history. Credit unions are only open to members, so if you or a member of your household does not live in the credit union’s service area, you or a member of your household may not be eligible for membership. For many consumers who have no personal ties to the communities served by credit unions, this makes banks a more appealing option; however, some credit unions may allow you to join for a small membership fee.

Banks, on average, have more branches and ATMs than credit unions. Because you may be able to find branches and ATMs throughout your city, state, and even across the country, it is easier to access your money from a bank. Credit unions, on the other hand, frequently partner with other cooperatives to expand branch locations and provide nationwide access to fee-free ATMs.

Banks typically outperform credit unions when it comes to financial technology. Because banks are for-profit companies, they can invest in things like mobile banking apps, which have become increasingly important in a society that operates 24 hours a day, seven days a week. While many credit unions have worked to improve services such as mobile check deposits and banking apps, they are not always as technologically advanced as banks. Finally, while both banks and credit unions offer many of the same services, banks are more likely to have a wider selection.

Despite the fact that business loans are a common feature of bank operations, not all credit unions do. Unlike credit union cards, which tend to be more basic, bank-issued credit cards are more likely to provide cardholders with more and larger incentives.

As a cooperative financial institution, a credit union prioritizes its members. Credit unions are known for their excellent customer service. A member can expect personalized service and a commitment to meeting their needs when they walk into a credit union branch. Furthermore, even if you leave the credit union-supported organization or community, your membership in the credit union is permanent. As part of their services, credit unions also provide important financial education to their members.

In addition to the types of online materials and resources that can be found on many banking websites, many credit unions offer in-person lectures on critical financial topics like managing credit cards, combating identity theft, buying a home, planning for retirement, or estate planning. The financial advantage is the most significant for credit unions. The average annual financial benefit for a single credit union member in 2018 was $85, according to research published by the Credit Union National Association (CUNA). The household benefit was $178.

So, how do regular credit union members view these benefits? To begin, the credit union’s profits will be distributed to its members in one of two ways: through interest earned on their deposit accounts or through dividend checks sent out on a regular basis. Furthermore, credit unions frequently have no minimum balance requirements, lower account opening deposit requirements, and lower overdraft, non-sufficient funds, and ATM fees because they are nonprofit. Finally, a credit union is more likely than a bank to offer lower loan interest rates.

If you have been scammed through online, then contact us to get your money back!

Another Scandal for This Bank

The Federal Trade Commission has reached an agreement with Ford Motor Credit Company (Ford Credit), Ford Motor Company’s auto finance business, for alleged violations of the Equal Credit Opportunity Act, in which Ford Credit will pay $650,000 in consumer redress and administrative costs (ECOA).

According to the FTC, from May 1994 to August 1995, Ford Credit discriminated against some credit applicants by failing to aggregate the income of unmarried joint applicants while aggregating the income of married applicants. According to the FTC, as a result, many unmarried joint applicants were allegedly offered credit on less favorable terms than married applicants. Ford Credit is a Delaware corporation based in Dearborn, Michigan.

Franklin Acceptance Corporation, a Philadelphia-based lending company, paid a $800,000 civil penalty in May for alleged ECOA and Fair Credit Reporting Act violations, making the $650,000 settlement one of the largest ever reached by the Commission in an ECOA-related case. Under the terms of the proposed settlement, Ford Credit will be barred from participating in similar ECOA violations in the future, in addition to providing consumer remedies.

“Millions of people use credit,” said Jodie Bernstein, Director of the Federal Trade Commission’s Bureau of Consumer Protection, “and the Equal Credit Opportunity Act ensures that everyone gets a fair shot at it.” Lenders can use a variety of indicators to determine a consumer’s creditworthiness, but marital status is not one of them.Credit discrimination will not be tolerated, as this agreement sends a clear message to lenders and potential borrowers.”

The Equal Credit Opportunity Act (ECOA) and its accompanying Regulation B prohibit credit applicants from being denied credit based on their race, color, religion, national origin, sex, marital status, or receipt of public assistance. It’s against the law to undervalue or refuse to assess income based on marital status, according to Regulation B. According to the FTC’s complaint, Ford Credit violated the ECOA by discriminating against credit applicants by failing to combine the income of unmarried joint applicants while aggregating the income of married joint applicants in many cases between May 1994 and August 1995.

Under the terms of the agreement reached with the Commission, Ford Credit will pay $650,000 to credit applicants who were negatively affected during the period in question and submit an eligibility claim form. In addition, for the rest of its life, the company will be prohibited from discriminating against an applicant based on marital status in any component of a credit transaction, in violation of the ECOA and Regulation B. The complaints were filed, and the settlement was approved by the Commission with a 4-0 vote. The complaint and consent decree were filed in the US District Court for the Eastern District of Michigan on December 9, 1999.

Stay Clear of Blacklisted Banking Scam Companies Now!

The best way to avoid having your bank account or other personal information compromised is to be proactive in monitoring who has access to it. While the potential scams discussed in this article are banking-related, they are only a small part of the larger picture of identity theft. Because your bank accounts are the way you access and interact with so many aspects of your financial life, scammers are ready to exploit any weaknesses related to your banking.

If something goes wrong or you are scammed, dealing with financial institutions that have been authorized or registered by us provides you with additional protection. Check the Financial Services Register to see if they’re authorized or registered.

It contains information about businesses and individuals who are or have been subject to our regulation. The amount of money you invest, the service the firm provides, and the permits the firm has will determine your access to the Financial Ombudsman Service and FSCS protection if you use an authorized or registered firm. The authorized or registered firm should be able to assist you if you have any questions about protection.

FAQ’s

Below are some frequently asked questions relevant to banking scams, frauds, and more

Why Is It Called a Blacklist?

People who are deemed difficult or non-conforming have been placed on official and unofficial blacklists for a long time.

Their identities have been erased. They should be avoided at all costs and dealt with as if they didn’t exist in the first place. In effect, blacklisting is a financial sanction intended to prevent people on it from accessing community resources.

What Happens When a Person Is Blacklisted?

Blacklisting is designed to take away a person’s ability to earn a living. Links to the professional world have been severed.

The individual’s reputation and social standing have been tainted. In the long run, the blacklist may be discredited. The Hollywood 10 were later praised for their bravery after being blacklisted for refusing to reveal their identities to the House Un-American Activities Committee.

How to Track Down Someone Who Scammed You?

The best way to find out who scammed you is to report it to the police. However, your chances of getting your money back are extremely slim.

You can look up the phone number and conduct a search. Catching a scammer is the most difficult task because scammers are rarely in the same location as you. Scammers on the internet could even be bots. The chances of catching the con artist are slim.

The most effective method for locating someone who has defrauded you is to use the internet.

If you’ve been the victim of a financial scam, it’s critical to find the perpetrator. Many scams operate by remotely controlling your computer, so any suspicious activity should be reported to your bank or credit card issuer as soon as possible.

Any loan offers you receive on social media or through online ads should be reported to your card issuer, or a fraud alert placed on your credit report. Advertisements for advance-fee loans should be avoided.

1. Report a scammer to the card issuer or bank

There are a few things to think about before reporting a scammer to your credit card company or bank. To begin, you must report fraudulent charges within 60 days under the Fair Credit Billing Act. That is a significant amount of time. As a result, as soon as you notice any unusual activity, you should contact your card issuer. Checking your monthly statement for unauthorized charges is the best way to do this.

Don’t dismiss the scammer’s attempts if you do lose money. If you discover that the scammer has obtained your credit card number, contact the card issuer or bank right away.

You can also contact the federal government or your state’s consumer protection office to report the incident. The government can track scam patterns and take legal action against businesses that use deceptive practices. However, it’s unlikely that you’ll be compensated for the money you’ve lost. Phishing emails frequently contain links to bogus login pages. These emails ostensibly come from your credit card company or a government agency. They’ll try to figure out how to log into your account. You should never go to your card issuer’s website by clicking on links in these emails. Scammers may use your personal information to make fraudulent purchases on these websites. Be wary of any requests for credit card information when logging into your account.

2. Place a fraud alert on your credit report.

Placing a fraud alert on your credit report can help you avoid becoming a victim of identity theft. This alert informs creditors that they must verify your identity before extending credit to you.

This alert can last up to a year, but you can cancel it at any time. During this time, you should check your credit report on a regular basis for any fraudulent activity. Place a fraud alert with one of the three credit bureaus if you suspect someone has been using your information. All three major credit bureaus will place a fraud alert on your credit report for free. This alert effectively prevents fraudulent activity on your credit report if you have been scammed. It can assist you in identifying the perpetrator and preventing further damage. The fraudster will be unable to use your credit for any fraudulent purposes if you request a free copy of your credit report.

Your creditors will be unable to open new accounts or increase your credit limit if you place a fraud alert on your credit report. It’s simple to do and will protect your identity from theft. If you’re not sure you’re not a victim of fraud, a security freeze may be a better option. It will make it difficult for the perpetrator to open a new account in your name by preventing lenders from releasing information from your credit report without your permission.

3. Be wary of loan offers on social media or online ads.

Online ads and loan offers on social media can be suspect. Fake loans may appear to be legitimate at first glance, but savvy users should be wary of them.

Advertisements from reputable banks and NBFCs are genuine. Sensitive financial information, such as bank login and password, credit card number, or CVV, may be requested in social media posts about loans. Report the incident to your local cybercrime unit if you are asked to provide such information.

Scammers frequently demand a large upfront payment for the loan. They then act as if the transaction is being processed electronically through a bank account. Legitimate lenders will not request a down payment or a bank account number in advance. They will never force you to sign a contract before you have read the fine print.

Furthermore, legitimate lenders will not request bank account or credit card information. You’ll be able to avoid falling victim to a scam if you learn about it on social media or through online ads.

4. Beware of advance-fee scams.

Scammers and advance fee fraud should be avoided! Advance fee scams are common, especially when services must be paid in advance.

These schemes can take the form of any scheme that promises to help you pay off debt, find work, or invest in a small business. They may appear to be official, but they aren’t. They might use fictitious agency names and logos, or they might use personal information you’ve already given them to commit fraud.

Recovery scams target scam victims who have recently been duped. These con artists frequently pose as government officials, attorneys, or recovery companies, offering to assist you in recovering the funds you have lost. Assume you’ve been duped by a recovery scam.

If that’s the case, you can seek assistance through the CFTC’s Reparations Program or the NFA’s arbitration process. You can also look up who is registering the company in the BASIC database.

If you’re dealing with a scammer, don’t send any money until you’ve double-checked that you’re not making an advance payment. You’ll be asked to send money via wire transfer, which is similar to sending cash. The money is unlikely to be found again. Be suspicious of requests for personal information or bank account numbers. Strangers are not asked for this information by bank accounts or credit card companies. You should never give out such information over the internet.

5. Be on the lookout for phishing emails.

Phishing emails should be avoided at all costs! Phishing emails appear and sound legitimate. The company logo and address, as well as the contact email address, may be included.

However, there is one telltale sign that they are fakes: an error in the email! This could be due to a faulty translation from another language or a deliberate attempt to circumvent email filters. In addition, phishing emails usually contain a cryptic string of characters rather than the sender’s address.

A threat or a desperate call to action is a common phishing attack. A link to enter personal information or download an attachment may be included in the message.

This type of massage creates a false sense of urgency, causing you to make snap decisions without consulting your trusted advisors. Instead, take your time and think before you respond to the phishing email.

Before clicking on a link in an unsolicited email, double-check the website’s contact information with a reputable source. Never respond to an unsolicited message using the contact information provided. Allowing remote access to your computer is never a good idea. If you get an unsolicited call, ignore it. Put the phone down. A well-known company may be mentioned, and the caller may ask you to download a free upgrade. These con artists typically attempt to gain access to your computer and install malicious software.

6. Beware of phone scams.

The “say yes” phone scam is becoming increasingly common. When a stranger calls and asks you a question, be cautious about allowing them into your home.

The scammer can use the voiceprint created by the answer to impersonate a legitimate company. To make sure the company isn’t a scam, contact your state’s Attorney General’s Office.

Another common technique used by scammers is to pretend to be someone they know and trust. They could impersonate a government agency or a well-known corporation. They may request payment by wire transfer, gift card, cash reload card, or money transfer app. Run if they ask you to give them money over the phone! Don’t let them get away with it – they’re most likely con artists.

The most straightforward way to avoid being conned by phone scammers is to be wary of anyone who requests personal information. Don’t give them your financial information because they’ll use it to make false promises. Charity fundraisers or “charity” scams are the most common scam calls. False promises of free grants or lotteries are common in charity fundraisers. If you don’t pay, they may threaten to put you in jail. Be wary of these con artists and remain vigilant!

7. Beware of SIM swapping.

Let’s say you’ve recently lost cell phone service or noticed unusual activity on other accounts. You may have been a victim of a SIM swapping scam in that case.

There are several ways to protect yourself and your money, even if it is difficult to detect. The first step is to notify your mobile service provider of any unusual charges. Also, if you suspect a SIM swap, change your passwords as soon as possible.

The attacker usually starts the SIM swapping scam by obtaining the victim’s personal information. They can either purchase it from organized criminals or obtain it by sending phishing emails. Viewing your social media profiles is another way to gather personal information.

You might come across information such as your mother’s maiden name, high school mascot, or other pertinent details. This information will be used by the attacker to impersonate you.

The attacker can intercept your texts and phone calls, as well as receive password reset texts and two-step verification tokens for your accounts, if you use a SIM swap. Furthermore, they have the ability to change your personal information and even create new accounts in your name. They’ll even transfer money between your accounts if that isn’t enough. As a result, you must be cautious when dealing with SIM swapping scams.

What can a con artist do with my bank account information?

Scammers are increasingly cold calling or emailing people and convincing them that they work for banks. Scammers pretend to be victims of fraud and ask for personal and security information in the hopes of securing the account when, in reality, they are accessing it fraudulently.

When scammers gain access, they frequently transfer any money in the account and then vanish. If you believe your account has been hacked or that you’ve been scammed, notify your bank as soon as possible so that your account can be frozen and your funds recovered.